Image

An announcement of a $15.1 million reward to a tipster of a tax evasion scheme are actually vague, even the area of the country the scheme occurred! The details and discussions concerning the tipster and the tax evasion scheme are filtered through two attorney groups hired by the whistleblower, who remains anonymous. The spokesperson refers to the scheme as tax avoidance rather than evasion.

"Today's award serves to reinforce that the IRS Whistleblower Program is critical in going after wealthy individuals who are evading tax," Zerbe said in a statement. "The IRS would have struggled significantly in bringing an enforcement action against these tax cheats but for the good work of the whistleblower."

Ironically, that whistleblower's windfall is subject to taxes too. Although the amount could be reduced by using IRS Form 14693 "Application for Reduced Rate of Withholding on Whistleblower Award Payment"

The whistleblower's two attorney groups have experience with IRS whistleblowers:

The Whistleblower program, now 26 USC 7623(a), has been on the books since March 1867, allowing the Secretary of the Treasury to pay such amounts as he deems necessary “for detecting and bringing to trial and punishment persons guilty of violating the internal revenue laws or conniving at the same.” History of the Whistleblower Program

The Whistleblower Program prior to enactment of the Tax Relief and Health Care Act of 2006 had a maximum award percentage of 15% of collected taxes and penalties.

It should be noted the qualifiers for receiving a whistleblower reward (IRC section 7623(b) award program) stipulate information must:

While the announcement in 2021 of a quest to hire 87,000 IRS agents met with great resistance and concern, the detail not included in most pulse-generating, inflammatory news blurb, was the context and timeline: A May 2021 Treasury report detailed what could be done with $80billion in additional funding, over 10 years, and an additional 86,852 employees.

Meanwhile, a September 2023 announcement by the IRS to hire additional 3,700 was more palatable and received little attention compared to the media incitement in 2021. This is part of a push against "wealthy" tax evaders in addition to $78.9 BILLION dollars funding via the Inflation Reduction Act.

How Might the Internal Revenue Service Use $78.9 Billion in Mandatory Funding? IN12050

The IRA specified that $78.9 billion should be distributed among the IRS’s four appropriation’s accounts, as follows: (but no mention of a whistleblower budget)

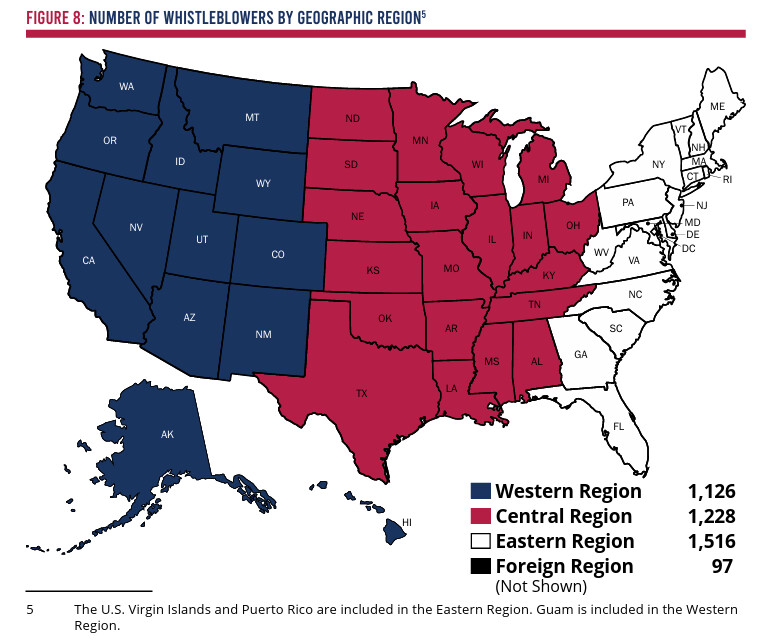

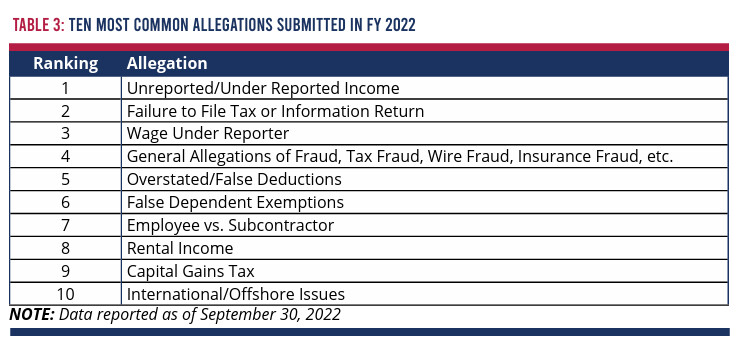

FY2022 Whistleblower Report to Congress p5241.pdf (irs.gov)

Fiscal Year 2022 annual report IRS Whistleblower Office

Fiscal Year 2022 annual report IRS Whistleblower Office Fiscal Year 2022 annual report IRS Whistleblower Office

Fiscal Year 2022 annual report IRS Whistleblower Office Fiscal Year 2022 annual report IRS Whistleblower Office

Fiscal Year 2022 annual report IRS Whistleblower OfficeIRS Releases 2023 annual report 12/4/23 p3583.pdf (irs.gov)