Image

3 years after the start of the Covid Shutdown, when a dramatic decline in film production in Los Angeles brought new sites to the attention of the industry, the 5 memeber LA County Board of Supervisors are looking for solutions. Agenda (kc-usercontent.com) While current statistics are not easily visible.

Long Term Supports for the Film Industry in Los Angeles County include a proposal to identify an economic development firm to study various strategies that could incentivize new and continued movie, commercial, and television production in the County, the chosen firm would have predictive analytical capacity that will provide evidence-based recommendations to

the County......

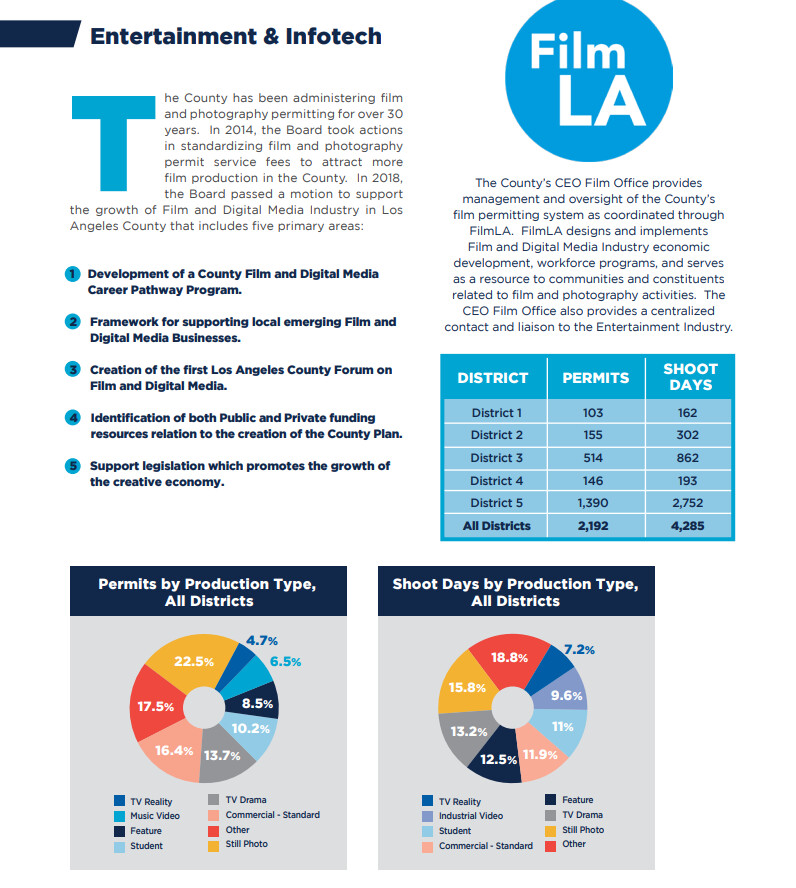

The LA County Film Office – Economic Development Program sites 2016 statistics on its front web page:

Los Angeles County Film and Digital Media Industry 2016 statistics

LA County & Municipal Incentives Include

The City of Los Angeles provides, free use of any available, city-owned locations for filming, including the iconic Los Angeles City Hall. Visit FilmL.A. to find a free filming location and arrange to use it in your next film production.

Entertainment Production Tax Cap: Tax liability is $145 for the first $5 million in production cost plus $1.30 for each additional $1,000 or fractional part thereof (maximum tax liability not to exceed $9,100).

Business Tax Exemptions: Business tax exemptions are available for qualifying new businesses, small businesses, and creative artists. Reduced tax rates are available to motion picture production businesses as well as businesses taxed on gross receipts.

Creative Artist Tax Exemption: No tax is required to be paid by a person for gross receipts attributable to “Creative Activities” unless the total taxable and nontaxable gross receipts exceed $300,000 annually.

City of Santa Clarita: Offers a three-part film incentive program that subsidizes/refunds basic permit fees for California Film & TV Tax Credit Program approved productions; provides partial refunds of Transient Occupancy (Hotel) Taxes. Visit the Santa Clarita Film Office for more information.

Economic-Development-Scorecard-BM-and-Report_08-04-21.pdf (lacounty.gov)

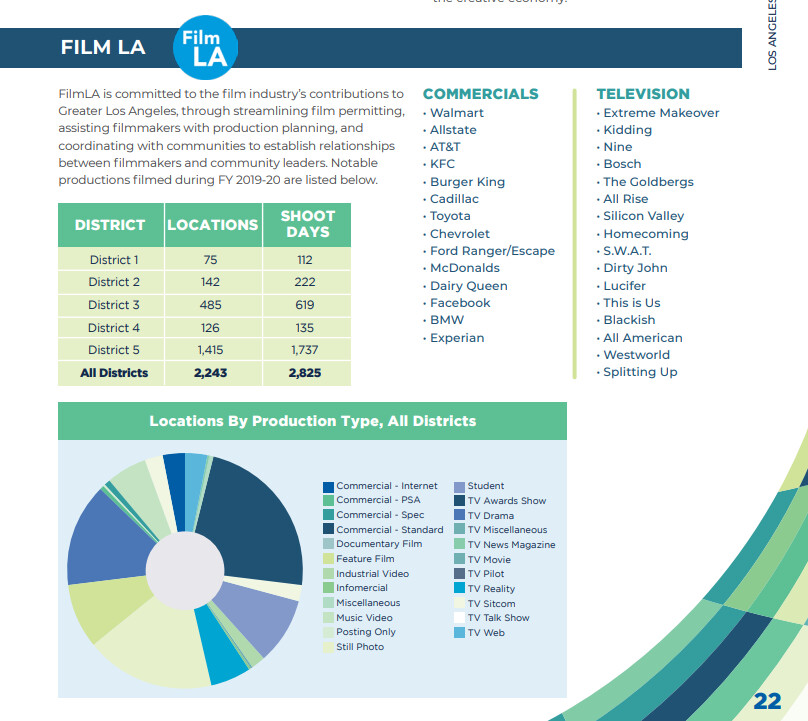

FY2019-2020

December-2018-Economic-Development-Scorecard-FY2017-18.pdf (lacounty.gov)