Image

The Corporate Transparency Act of 2021 gave The Financial Crimes Enforcement Network (FinCin), a division of the Department of Treasury, the authority to create a database of business “beneficial” ownership information, as a means to identify individual owners of privately held assets.

"Starting January 1, 2024, many companies will be required to report information to the U.S. government about who ultimately owns and controls them." Beneficial Ownership Information Reporting | FinCEN.gov

An Introduction to Beneficial Ownership Information Reporting

Small Entity Compliance Guide | FinCEN.gov

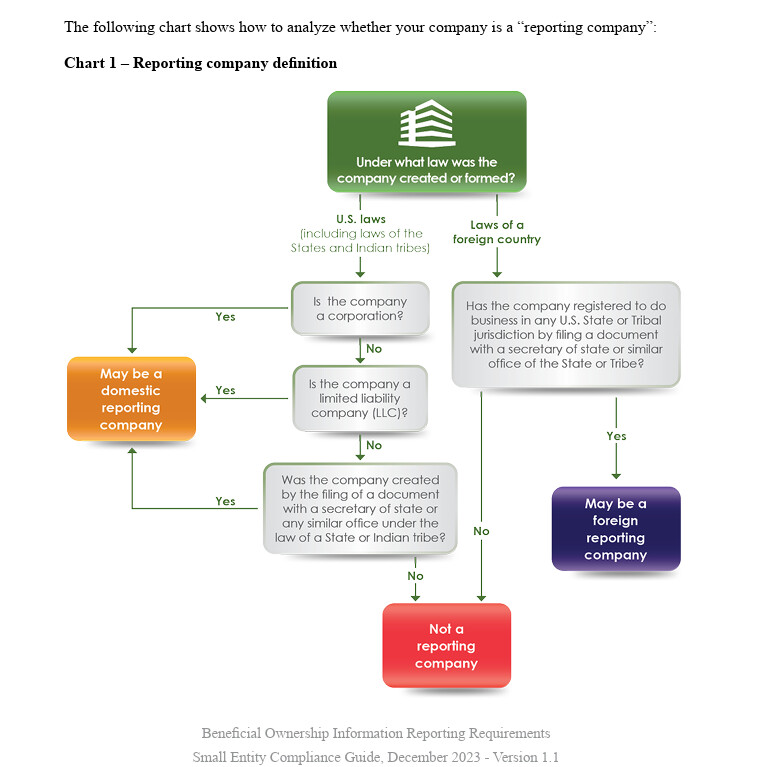

The Reporting Rule, issued on September 30, 2022, implements Section 6403 of the Corporate

Transparency Act. The rule describes who must file BOI reports, what information they must

provide, and when they must file the reports.

Why do companies have to report beneficial ownership information to the U.S. Department of the Treasury?

In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures. [Issued September 18, 2023]

FinCEN will permit ... beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement...to:

Beneficial Ownership Information Reporting | FinCEN.gov

A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025 to file its initial beneficial ownership information report.