Property Tax Proposed Changes

Statewide - an initiative is in the process of qualification for the November ballot which changes property tax rules for transfers between family members.

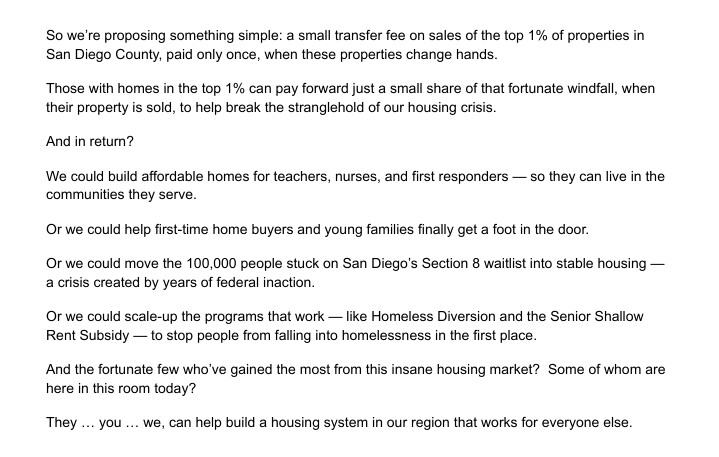

2025: The Fluctuating Transfer Tax was proposed last April by San Diego County Board of Supervisors Chair Terra Lawson-Remer. In her State of the County address, she called for a “small transfer fee on the top 1%” of real estate holdings in the county. 2025 State of the County Address - Supervisor Terra Lawson-Remer she estimated such a tax would generate $1 billion in revenue for the county.

CURRENTLY:

City of Los Angeles – $4.50 CITY TAX Per $1,000

$5,300,000-$9,999,999 – Additional 4%

$10,600,000+ – Additional 5.5%

(Eff. 07/01/2025)

County of Los Angeles - Seller: $1.10 COUNTY TAX Per $1,00

November 2022: Measure ULA passed by Los Angeles City voters it became effective rapidly, January 1, 2023 Real Property Transfer Tax and Measure ULA FAQ | Los Angeles Office of Finance

Measure ULA (United to House L.A.) introduced a new provision, Section 21.9.2(b), to the Los Angeles Municipal Code. "Measure ULA established the ULA Tax to fund affordable housing projects and provide resources to tenants at risk of homelessness. The ULA Tax is imposed on all documents that convey real property within the City of Los Angeles when the consideration or value of the real property interest conveyed exceeds a threshold of five million dollars, or is ten million dollars or greater, respectively."

THEN "Effective for transactions closing after June 30, 2025, the new thresholds for ULA will be $5,300,000 and $10,600,000. Transactions above $5,300,000 but under $10,600,000 will be assessed a 4% tax and transactions $10,600,000 and up will be assessed a 5.5% tax."

More News from Los Angeles

- Homeless Outreach: Shepherd Chuch An ongoing effort from the Shepherd Church exists to provide lunches and spiritual support to those homeless.

- Fatal Pedestrian Hit-and-Run Crash in Canoga Park: 2024 & 2026 A fatal hit-and-run crash in Canoga Park 2/5/26 with a $50K reward repeats a similar pedestrian fatality in December 2024.